Customer deposits continue to show an upward trend in the Panamanian banking system, as reflected in the Banking Activity Report for February 2022.

News

The Superintendent of Banks, Amauri A. Castillo, received a courtesy visit from Mr. Gerd Weissbach, Director General for Sparkassenstiftung Alemana Latinoamérica.

With the purpose of strengthen technical activities and the students’ learning process, the Superintendency of Banks of Panama (SBP) made a significant donation of technological equipment to Centro Regional de Panamá Oeste of Universidad Tecnológica de Panamá (UTP).

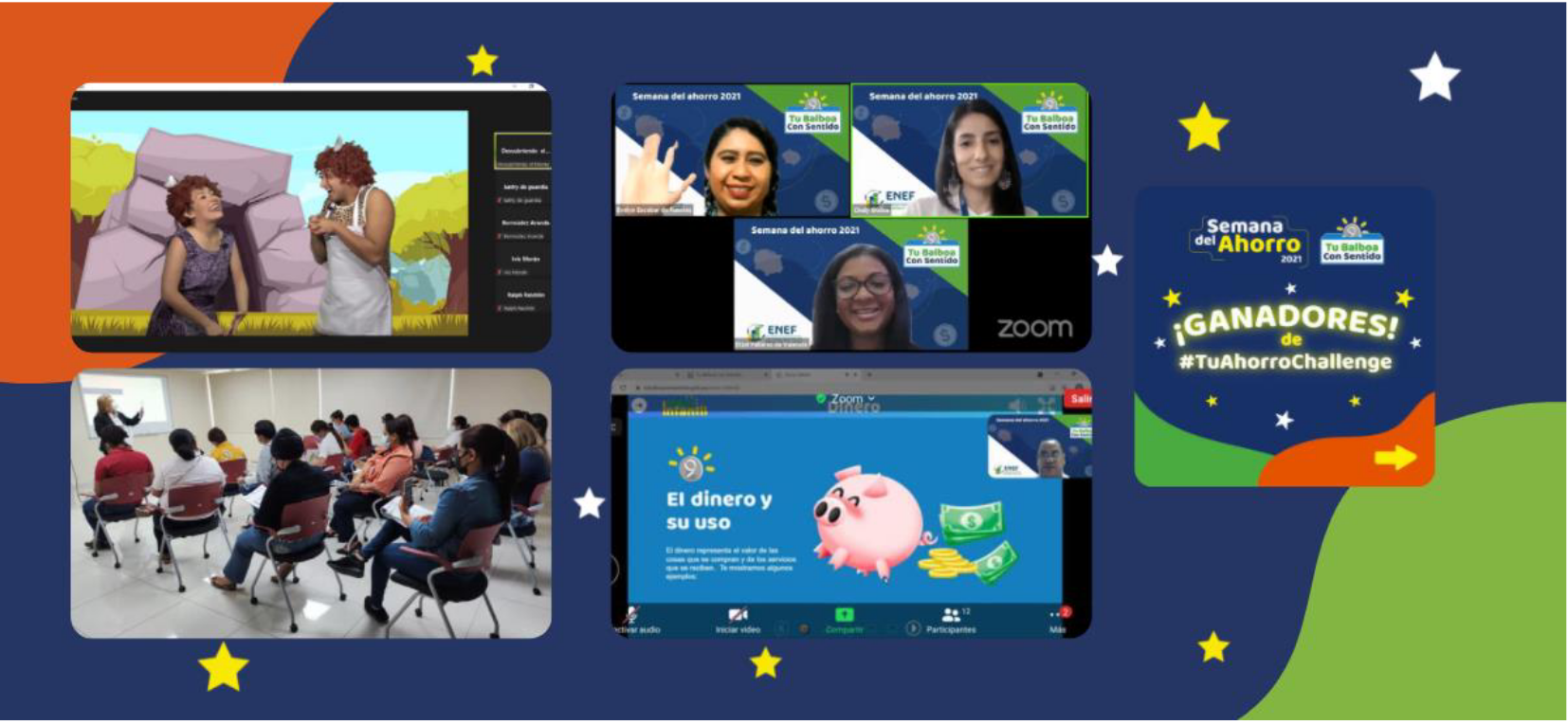

Focused on enhancing the National Strategy for Financial Education (ENEF, for its acronym in Spanish) initiative, which aims to raise the financial culture of the country, the Superintendency of Banks of Panama (SBP) participated in the David International Fair 2022 with the stand “Tu Balboa con Sentido.”

According to the Banking Activity Report (IAB, for its acronym in Spanish), issued by the Superintendency of Banks of Panama, the deposits recorded in the banking system as of January 2022 totaled USD 98.56 billion, an increase of USD 2.11 billion versus January 2021.

- Depositors are confident of the banking system.

- The modified [loan] portfolio shrunk by 59% or USD 13.69 billion.

As of Wednesday, February 23, 2022, the modification of the percentages for the distribution of the Special Interest Compensation Fund (FECI, for its acronym in Spanish) to the agricultural sector came into force, announced by the President of the Republic, Laurentino Cortizo Cohen...

The Development Bank of Latin America (CAF) is part of the multilateral institutions supporting the initiative for the implementation of the National Strategy for Financial Education (ENEF, for its acronym in Spanish) in Panama.

During 2021, the Superintendency of Banks held 498 training sessions on topics related to technical knowledge, skills development, and complementary training.

The Superintendency of Banks of Panama (SBP) and the Panamanian Institute of Autonomous Cooperatives (IPACOOP) signed a collaboration and cooperation agreement to continue raising the financial education of the Panamanian population.

According to the Banking Activity Report as of November 2021, new loans granted by the National Banking System (NBS) stood at USD 15.96 billion, which represents an increase of 17% versus the same period of 2020, when it reached USD 13.60 billion, i.e. USD 2.37 billion more.

The Superintendency of Banks of Panama (SBP) participated in the “IV Convention on International Regulations” held by the Instituto Guatemalteco de Contadores Públicos y Auditores (IGPA – Guatemalan Institute of Public Accountants and Auditors).

The National Authority for Transparency and Access to Information (ANTAI, for its acronym in Spanish) qualified and certified the Superintendency of Banks of Panama (SBP) with a score of 100 for reaching the maximum level in the annual assessment that measures compliance with Law 6 on Transparency in Public Management.

The net loan portfolio of the International Banking Center (IBC) recorded a 1.9% growth, as of October 2021, by amounting to USD 72.83 billion, USD 1.35 billion more than that of October 2020, when it totaled USD 71.47 billion.

The Superintendency of Banks of Panama (SBP) held the “2021 Journalist Training” for journalists specializing in the financial sector. The training was aimed at reinforcing knowledge on banking supervisory and regulatory matters.

The efficient and rational use of energy, the implementation of non-conventional technologies, and educational and outreach actions were the topics discussed at the meeting recently held between Dr. Yovani Barría, Project Coordinator of the National Energy Secretariat (SNE, for its acronym in Spanish) and members of the Energy Saving Committee of the Superintendency of Banks of Panama (SBP).

The Superintendency of Banks of Panama remains committed to share valuable information and experiences of the banking and fiduciary sector, with the help of renowned speakers, by holding the 19th Banking and Fiduciary Update Seminar entitled “The Challenges of an Inclusive Regulatory Framework in Judicial Management.”