The Board of Directors of the Superintendency of Banks of Panama (SBP) issued Rule 1 of 2026, dated January 16, 2026, through which it updates provisions aimed at preventing the misuse of banking and fiduciary services, with the objective of strengthening the regulatory framework applicable to supervised entities and consolidating the control and oversight mechanisms of Panama’s financial system.

News

From October 27 to 30, the Superintendency of Banks of Panama (SBP) hosted the in-person course “Consolidated Supervision and Risk Integration,” a high-level program delivered by specialists from the Board of Governors of the Federal Reserve System (Fed), aimed at professionals with extensive experience in banking supervision and regulation.

The Superintendency of Banks of Panama (SBP) held a solemn ceremony in honor of the memory of Mr. Rafael Guardia Pérez, a former member of its Board of Directors, in recognition of his invaluable contributions, leadership, and commitment to institutional strengthening and the development of the International Banking Center.

The net loan portfolio of the International Banking Center (CBI for its acronym in Spanish) grew by 5.91%, reaching USD 100,578.9 million, representing a year-on-year increase of USD 5,608.4 million compared to the same period of the previous year. This performance consolidates the loan portfolio as the main driver of asset expansion as of November 2025, according to the Banking Activity Report (IAB) issued by the Superintendency of Banks of Panama (SBP).

The Superintendent of Banks of Panama, Milton Ayón Wong, presented the SBP’s 2025 report on advances in Anti–Money Laundering, the Financing of Terrorism, and the Financing of the Proliferation of Weapons of Mass Destruction (AML/CFT/CFP), during the Expanded Meeting of the National Commission against Money Laundering (CNBC), a forum that brought together key stakeholders from Panama’s financial system.

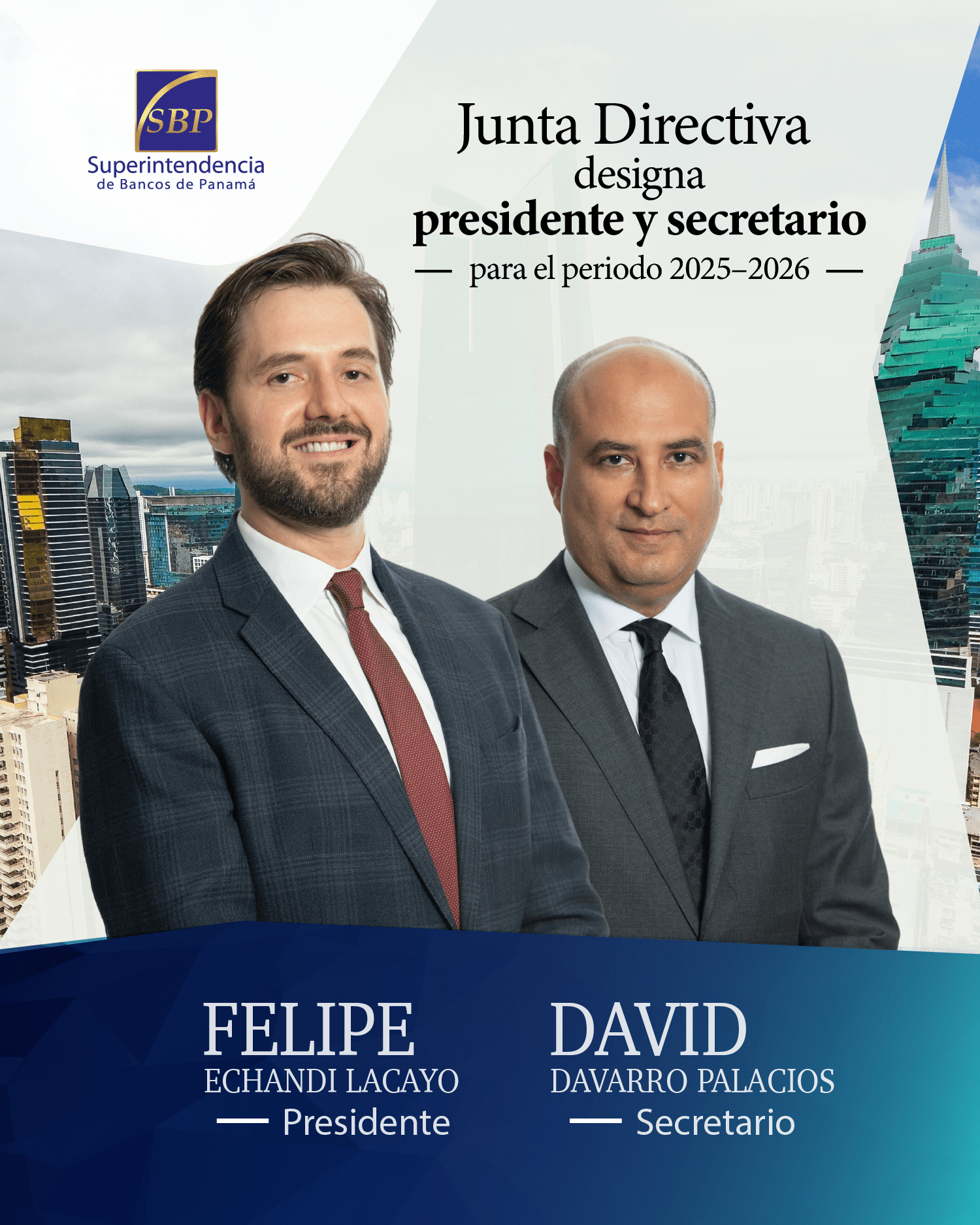

The Board of Directors of the Superintendency of Banks of Panama (SBP) has appointed Board members Felipe Echandi Lacayo and David Davarro Palacios as Chair and Secretary, respectively, for the term spanning December 16, 2025, to December 15, 2026.

The Superintendency of Banks of Panama (SBP) continues to promote the country on the international stage, this time at the 2025 Panama Week South Africa, an initiative organized by the Embassy of Panama in South Africa to strengthen diplomatic, cultural, and commercial relations between the two countries. This event seeks to foster a strategic partnership, aligning with Panama's objective of expanding cooperation with Africa and leveraging South Africa's strategic location.

The Superintendency of Bank of Panama (SBP) approved Rule 9-2025, a regulation that modernizes and streamlines the administrative procedure for handling complaints filed by banking consumers.

The International Banking Center’s (IBC) net credit portfolio reached USD 100,088.9 million, representing a 5.5% increase as of October 2025 compared with the same period last year.

More than 500,000 savers will benefit this year.

More than 500,000 Panamanians will receive their Christmas savings, totaling USD 272 million in disbursements by the banks that make up the National Banking System (SBN). This figure reflects an 11% increase—or an additional USD 28 million and 59,565 new accounts, up 13% compared with the same period last year.

As part of its ongoing effort to promote awareness and training initiatives aimed at reinforcing the culture of compliance, the Superintendency of Banks of Panama (SBP) launched the 8th Awareness Workshop, “From Theory to Action: Effective Strategies for Preventing ML/TF/PFADM.”

The Superintendency of Banks of Panama (SBP) has updated the provisions of its existing Memorandum of Understanding with the Financial Services Commission of Montserrat, with the purpose of further strengthening consolidated and cross-border supervision of banks and banking groups regulated by both authorities.

As part of the official visit to the country, the mission of the International Monetary Fund (IMF) was received by the Superintendent of Banks, Milton Ayón Wong, along with his technical team.

The Superintendency of Banks of Panama (SBP) held the Seventh Supervisory College of Grupo Financiero Ficohsa, for which it serves as home supervisor, with the purpose of advancing supervisory work through the exchange of information and experiences.

The International Banking Center (IBC) closed the 2025 third quarter with results that demonstrate structural strength and financial stability despite a challenging global environment. While financial margins have narrowed, banking system profitability remains solid, supported by effective risk management and broad geographic diversification.

The Superintendent of Banks, Milton Ayón Wong, participated in the 2025 Annual Meetings of the Association of Supervisors of Banks of the Americas (ASBA), held from October 21 to 24 in Port of Spain, Trinidad and Tobago.

As part of its commitment to transparency, financial system integrity, and inter-institutional cooperation, the Superintendency of Banks of Panama (SBP) conducted a series of training sessions focused on the prevention, detection, and investigation of financial crimes.

Technical staff from the Superintendency of Banks of Panama (SBP) actively participated in the 34th Latin American Trust Congress (COLAFI) 2025, held from October 1 to 3 in Antigua, Guatemala. This event brought together fiduciary and financial experts from across Latin American to exchange experiences and analyze the most relevant trends in the trust industry.

The Superintendency of Banks of Panama (SBP) joined the 40th Latin American Congress on Banking Security (CELAES 2025), held in Panama on October 2 and 3 at the Sheraton Grand Hotel Convention Center.

According to the Banking Activity Report (IAB) issued by the Superintendency of Banks of Panama (SBP), the net credit portfolio of Panama’s International Banking Center (CBI) strengthened its position as the main driver of asset expansion, recording a 7.80% increase as of August 2025 and reaching a total of USD 99.61 billion compared to the same period last year.