In an emotional recognition ceremony, the Superintendency of Banks of Panama (SBP), in partnership with Infoplazas AIP, celebrated the commitment and dedication of community facilitators who, through financial education, are transforming lives across the country.

News

The Superintendency of Banks of Panama (SBP) successfully concluded the SBP Innova 2025 Hackathon, a four-week initiative designed to foster creativity, collaboration, and innovation among its employees.

The Superintendency of Banks of Panama (SBP) held a roundtable discussion on Rule 3-2025, which introduces key amendments to Rule 4-2010 regarding the external audit of banks.

The Superintendency of Banks of Panama (SBP) hosted a training session for banking employees aimed at strengthening customer service across the national banking system.

The Superintendency of Banks of Panama (SBP) joined the XVII Annual Accounting Convention, organized by the College of Certified Public Accountants of Panama (CCPAP). This key event, held on September 17, brought together professionals from the accounting, tax, audit, and consulting sectors, spanning both the public and private spheres.

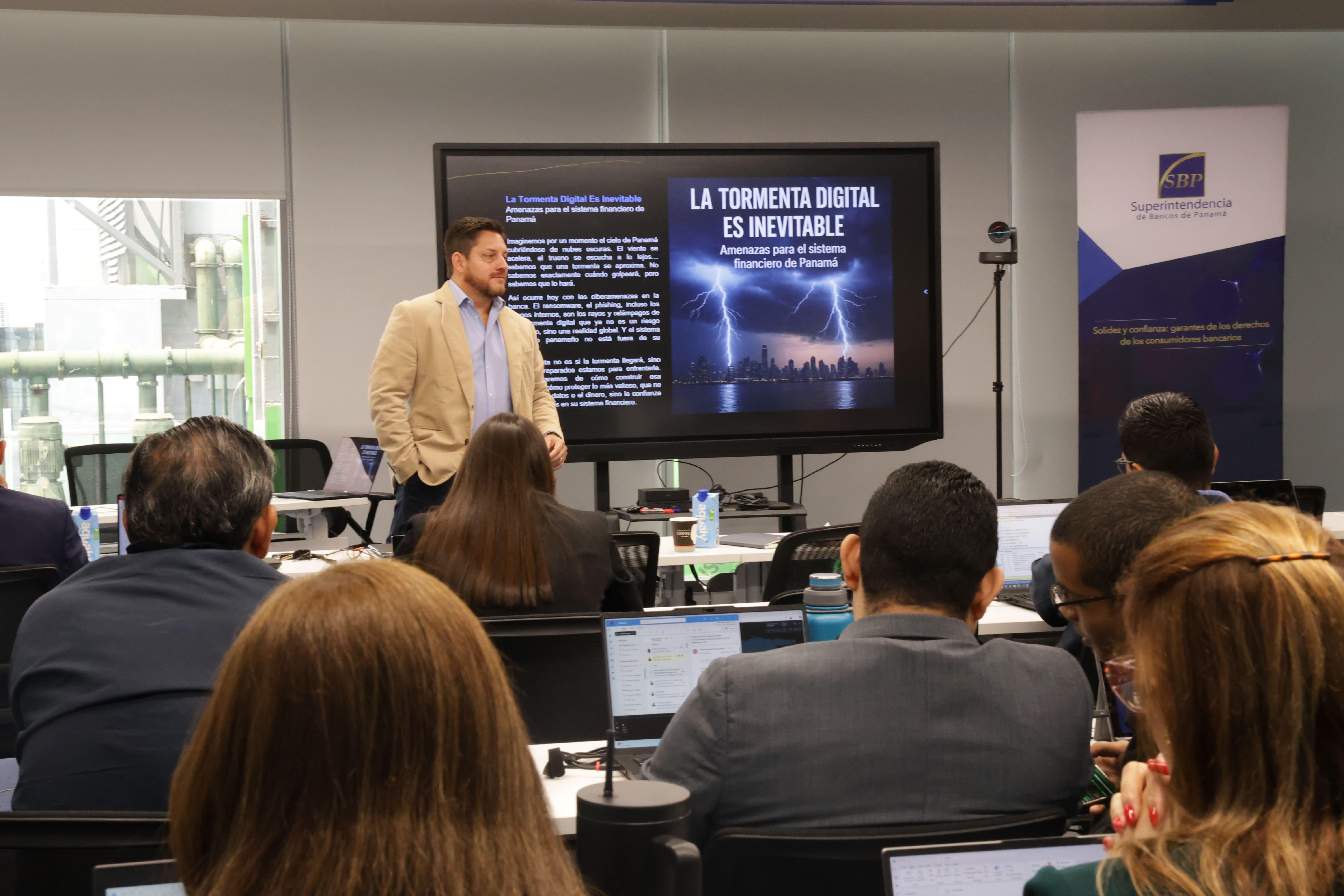

The Superintendency of Banks of Panama (SBP) participated in the Second Banking and Financial Forum, hosted by Deloitte Panama on September 11. The event brought together leading professionals from the financial and banking sectors, as well as auditors, to exchange perspectives on key industry challenges.

The Superintendency of Banks of Panama (SBP) conducted a specialized workshop with its technical team, focused on strengthening banking regulation through cutting-edge digital tools.

With steady progress toward strengthening Panama’s financial system, the Financial Coordination Council (CCF) successfully held its third Ordinary Meeting of the year at the facilities of the Superintendency of Banks of Panama (SBP).

Net loan portfolios have strengthened as the leading driver of asset growth in Panama’s International Banking Center (IBC), reaching a balance of USD 99,476.2 million, an increase of 8.01% or USD 7,381.1 million.

The Superintendency of Banks of Panama (SBP), in partnership with Great Place to Work®, held the workshop “The Strategic Role of the Leader in Business and Culture” as part of its institutional and cultural strengthening strategy.

The Superintendency of Banks of Panama (SBP) inaugurated the 23rd Banking and Fiduciary Update Conference entitled “Financial Evolution: AI and the New Legal Paradigm,” reaffirming its commitment to transparency, innovation, and legal certainty.

Staff of the Superintendency of Banks of Panama (SBP) successfully completed the Micro Credential in Digital Transformation, a 240-hour academic program offered by the Universidad Santa María La Antigua (USMA).

The program took place from August 18 to 22, 2025, and denoted an important milestone in the technical and strategic strengthening of 29 staff members of this regulatory and supervisory authority.

The Superintendency of Banks of Panama (SBP) presented its budget proposal for fiscal year 2026, totaling B/.29,850,000, to the Budget Committee of the National Assembly.

The Board of Directors of the Superintendency of Banks of Panama (SBP) issued Rule 7-2025 of August 5, 2025, “Establishing guidelines for the constitution and management of a capital buffer applicable to domestic systemically banks.”

The Board of Directors of the Superintendency of Banks of Panama (SBP) issued Rule 8-2025 dated August 5, 2025, “Whereby Articles 39, 41, and 42 of Rule No. 4-2013 on credit risk management and administration inherent in loan portfolios and off-balance sheet operations are amended.”

Superintendent of Banks Milton Ayón Wong met with United States Ambassador to Panama, Kevin Marino Cabrera, who was accompanied by Melanie Rose Carter, Deputy Economic Counselor at the U.S. Embassy.

With a firm commitment to reinforcing transparency, effective supervision, and the adoption of best financial practices, the Superintendency of Banks of Panama (SBP), acting as the home supervisor, organized the 5th Supervisors’ College of the BiCapital Group Corporation on August 7 and 8, 2025.

The Sustainable Finance for Development (FISDE) initiative promotes practical solutions and guides for integrating environmental, social, and governance (ESG) criteria into financial regulation and supervision.

The Superintendency of Banks of Panama (SBP) announces that, after verifying compliance with all applicable regulatory requirements, it has issued Resolution SBP-BAN-R-2025-00416, dated July 11, 2025, granting an International Banking License to BANCO BILBAO VIZCAYA ARGENTARIA COLOMBIA S.A. (BBVA Colombia S.A.)